Telecommunication companies are drawing up a mechanism to catch and blacklist multiple borrowers and defaulters of MoMo loans.

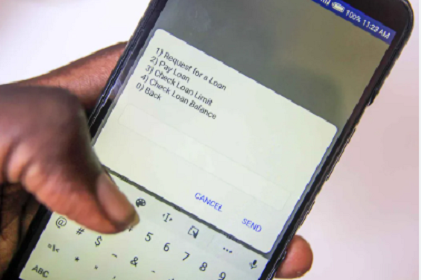

Through telecommunication companies, moneylenders are lending to Ugandans. These are instant, and the money is deposited in the subscriber’s mobile money account.

However, some intentionally decline to repay the loan, and as such, throw away the line or switch to a more secure line to continue with mobile money services.

Now, telecommunication companies are coming up with a mechanism where borrowers will first be put on a grey list before being blacklisted and not allowed to borrow from any other lender on a different network.

Sources in the MTN Uganda says that telcos are in the final stages of uniting under the Credit Reference Bureau, a platform that will give information on the borrower, their record, and National Identification Number (NIN). This, sources say, will help telcos follow up with all borrowers before blacklisting them. “As you are aware, these people only change phone lines, not NIN. So, once this is in place, they won’t have anywhere to hide but pay the loan,” a source says. This will mean that even if one borrowed money through their MTN line, they won’t be allowed to borrow using their Airtel line. Currently, one can borrow using an MTN line; for example, throw away that line, buy another one, and after six months, they are able to borrow again.

Sources add that this will be history once the proposed arrangement comes to pass.