By Prof. Augustus Nuwagaba

UNDERSTANDING OF THE RECENT SOARING OF COMMODITY PRICES IN UGANDA

In Uganda, we are currently experiencing what we call inflation, a technical term that refers to the general rise in prices of commodities.

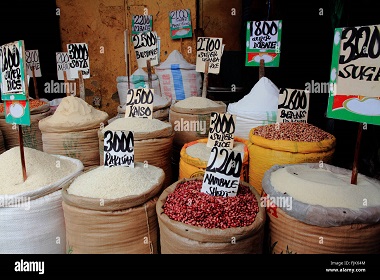

The prices that have sharply risen are those of soap and cooking oil, while sugar and rice have also registered high prices.

The major driver has been what we call imported inflation. This arises from the increase in prices imported raw materials and petroleum products and this has been a global phenomenon.

In United States for example, the price of crude oil soared from $ – 40 per barrel to $ 120, indicating an increase of 400%!! This has been unprecedented

The major reason is the high demand, unleashed by the opening of the economies, yet, the oil production capacity of oil producing countries remained the same at the COVID-19 period level. The implication is that high demand for petroleum products created a surge in price of oil.

It is clearly obvious that the price of petroleum products determine the transport costs of goods, which have to be borne by the final consumers of the commodities transported from production to consumption centres.

Otherwise, inflation cannot affect the price of a single commodity. It is usually a general rise in prices of commodities across the board.

However, it is instructive to note that the prices of foodstuffs have not drastically increased. This is because as Uganda, we domestically produce most food products like bananas, maize and beans in large quantities.

If the transport costs were not high, the prices of our food products would have been even much lower. The other driver of commodity prices are the production costs in form of high electricity costs and high cost of borrowing , which combine to drive the cost of doing business.

Government of Uganda has little space for maneuver in regard to price of commodities. This is because all oil companies are privately owned. They import their petroleum products and are free to charge in accordance to what makes sense for them.

The economy is liberal and it is not possible for Government to set prices of any product. Even the interest rates of commercial banks have remained high even when the Central Bank Rate (CBR) is set at just 6%.

The assumption was that commercial banks would accordingly reduce interest rates, but this has not happened. The reason is that these commercial banks are privately owned and therefore cannot be controlled by the Government. They are only regulated.

The writer is an International Consultant on Economic Transformation.